A Stop Limit Order Protects Most of the Times

A stop limit order is used as a protective sell when you cannot watch the markets or have found that when the time comes you cannot pull the trigger and get out of a losing position.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

Stop Limit Order vs Stop Order

With a stop limit order you place a sell stop, which has a specific trigger price and then you add a limit order to that. By doing this the stop trigger price identifies when the stop should be initiated and the limit order identifies your lower limit which tells the broker you will not sell below this level.

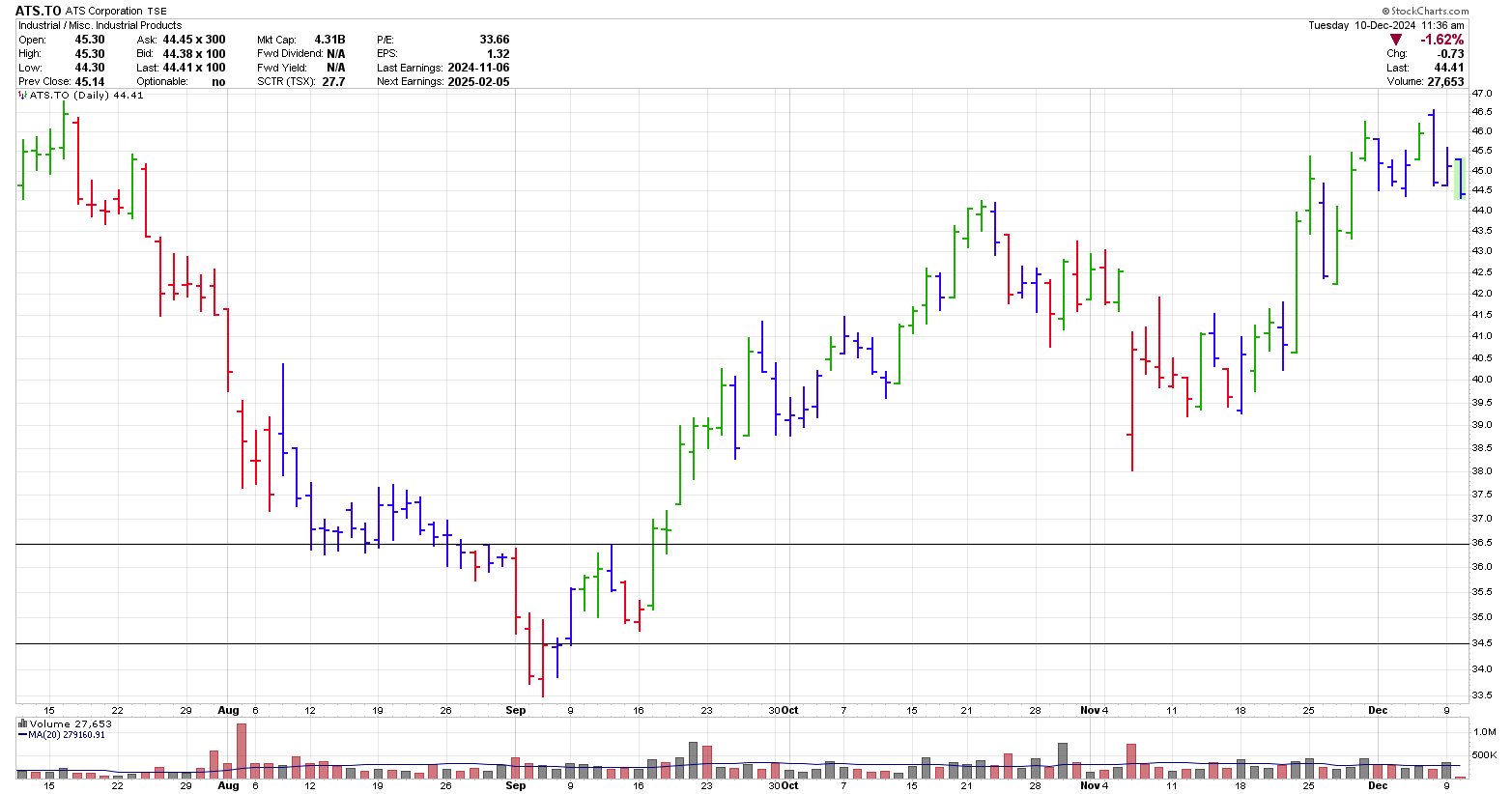

In the chart below, I have shown a stop limit order example. In this case, ATS.TO was purchased as it made a higher high on September 17, 2024. The low on September 16 is chosen as the exit point. A bit more room is desired so the stop trigger point is set to $34.49. The stop limit is put at $34.40.

The above stop limit order example tells your broker that you want to exit the stock once price trades at $34.49 or lower and you will accept any price down to $34.40.

You might ask what is the difference between a stop and stop limit

order? A stop order (sometimes called a stop market order) gets you out at the market once the trigger or a

lower price has been hit. Thus, in a situation where the price gaps

through your stop you will get out. When you have a limit in the order,

you will only exit the trade while price is at or above your limit.

Let's look at some numbers. In the above example two days after the trade is entered, price gaps down opening at $34.00. Since your limit is set at $34.40 your order will not get filled. For your your order to be filled, price would need to come back to $34.40. This is one concern with placing a stop limit order.

Stop Market Orders - Speed at a price

With a stop loss order in place at $34.40, when the stock gaps down to say $34.00 your stock will be sold at around $34.00. If this bothers you then place a stop limit order which means that you will add a limit to your stop loss. So while your stop loss order (sometimes refereed to a stop market order) will say sell at $$34.00, your stop loss limit order will say to sell at $34.49 and I will not sell below $34.40. By adding the limit you are telling your broker that you will only sell the stock if you can get at least $34.40.

As with most things in trading, there is a positive side and negative side to most of your actions. In this case, a stop market order is guaranteed to sell your stock and get you out of the market once a trade at or below your stop price has occurred. You will be really happy you have a stop market order in when price gaps below your stop and keeps dropping.

You won't be so happy when price opens below and then rises.

A Watch Out

Generally though, since the first loss is the best loss, it is likely better to just enter a stop market order and live with the odd time a really large gap comes along and prices continue to drop. Ultimately you will run into a situation where the stock blows through your stop limit order and keeps going down. So while you could have gotten out at say $34.00, provided you are around, you might get out at $33.

This is one of the largest concerns with placing limits on your stop orders. You may find, that at some point, you will lose far more because you placed a stop limit vs a stop market order.

Stop limit orders can also help you with stocks that trade low volume or have a large spread between the bid and asked. For most high volume stocks, the spread between the bid and asked is pennies so once your stop is hit you will be out at your stop price or perhaps a few cents below.

However, when you are in a stock with a low volume the spread may be in the 2 to 5 cent range. Thus, with a stop market order you can expect to sell at the bid while with a stop limit order you may get a slightly higher price.

You have to remember that when you place these types of orders in the market they will not always work out as planned. Stops, no matter where you place them, will cause you grief. Too tight and you sell prematurely. Too loose and you will lose too much money when the stock goes against you.

Unsure about limit and market orders then find out a bit more here to help you understand a limit order.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00