What number of stocks should I own?

It takes time to manage a large number of stocks,

use your time wisely

Generally, the number of stocks you own is determined based on your account size, type of trader you are, risk tolerance and the time you have to manage your portfolio.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

Trading in too many stocks becomes difficult to manage from a time perspective. If you have a lot of time to spend watching your stocks and keeping track of them then you can likely manage more.

One common problem is forgetting you even own a particular stock. There have been a few times where I totally forgot I even owned a position. This can have a sad or happy ending depending on the direction of the stock price.

According to William J. O'Neil's "How to Make Money in Stocks" in an account containing between $20,000 to $100,000 you should have between 4 to 5 stocks. For those with accounts between 5,000 to $20,000 you should limit yourself to 3 to 4 stocks.

On the other hand from a risk perspective, Alexander Elder in his book Come into My Trading Room suggests that the maximum amount you should risk per month is 6% of your account and that the maximum amount you should risk on any given trades is 2%. Therefore, assuming you want to risk 1% of your account per trade, you could have 6 open positions as a maximum. When one of your positions has a stop that, when triggered, will result in 0 loss or you have scaled out of the position such that the trade no longer presents any risk a 7th position can be entered.

Others have talked about a maximum of 5 to 10% of an account in each stock which would put the number of stocks you own in each account between 10 to 20.

The number of stocks you hold then should vary between 4 to 20 for most people for an account size of $20,000 to $100,000. This number of stocks would also align to higher account sizes as well.

Commissions will affect your trading account

Let us look at two traders. Both have $10,000 accounts and are looking at buying five different stocks. For this example, all of the stocks cost $10 and our traders want to spend $5,000.

Trader A pays $29 per transaction or $58 to get in and out of a stock. Therefore, when the trader buys 100 shares of each stock they will have paid $290 in commission or 2.9% in trading fees versus only 0.58% had they just bought 500 shares of one company.

The advantage of buying five companies is you will likely sell the worst ones quite quickly and hold on to the winners. Provided the winners go up more than $290 plus the losses incurred from the losing trades, the overall the trader will be a winner.

Trader B pays $1 per 100 shares or $2 to get in and out of a 100 shares of stock. Therefore, if the trader buys 100 shares of each stock they will have paid $10 in commission or 0.1% in trading fees whether they buy 500 shares or 100 shares of five different stocks. Making a profit in this scenario is much easier than in the above scenario.

The difference between the two traders is that Trader A is disadvantaged by buying different stocks while Trader B is not.

Time to Manage Your Stocks vs Trader Type

Think about two different types of traders: a day trader who is in and out of all their stock within a day vs a trader who holds for a few months.

As a day trader who is buying and selling stocks within the 6.5 hour time period the market is open how many stocks can you manage over that time period? For many this might be limited to 3 to 5 different stocks as you generally need to monitor them throughout the day. Even with 3 monitors it takes a lot of practice to manage 3 to 5 positions.

As a longer term trader who is holding for a few months they may typically look at their stocks once a day, they can easily monitor 10 to 20 stocks as they can have stop orders for both limit and exits in the market at all times.

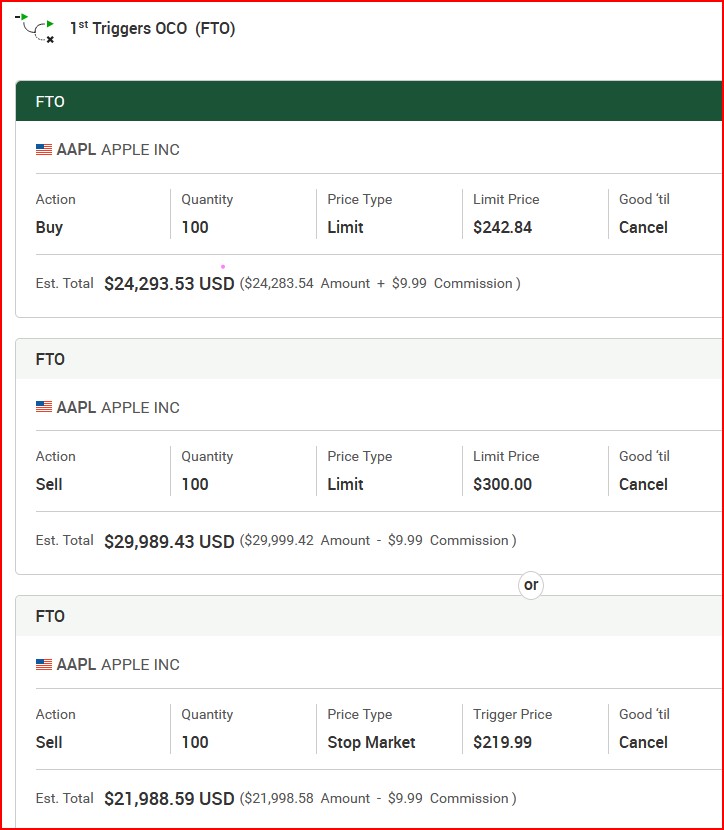

Below is an example of a one cancels other order for Apple.

By placing a 1st triggers one cancels other order as soon as the trade is entered the order automatically enters two exits. One for a profit exit and another for a stop loss. Thus, you can use technology to monitor your positions.

While it takes more time to manage, many traders feel safer by owning a large number of stocks. Identifying how you operate and your comfort zone will play a role in determining the number of stocks you should be trading.

In summary, your account size will determine the number of stocks you own as well as the type of trading you are planning on doing. Your risk tolerance and time requirements will also come into play as well.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00