What account size do I need to get started?

To have half a chance of success, your trading account size should be greater than $10,000

Your account size will determine the type of trading you do.

Your trading account should contain risk capital. Risk capital is money that you will not immediately need for an upcoming known expense such as rent.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

If you are trading a small account (let's say $10,000), you can trade and learn, but you should be placing small bets.

One of the basic rules to trading is to not lose your capital. When you have a small online stock trading account, commission charges will eat you alive when you are trading too often or paying too much in commission. You can go broke in no time at all if you do not pay attention to basic money management principles.

Also, when you follow a general rule stating you should not risk more than 2% of your capital, the most you should be planning on losing per trade would be $200. This tends to restrict the price of the stock that you can buy.

According to William O'Neil, in "The Successful Investor" the most you should lose on one stock is about 7%.

When the 2% and 7% rules are put together, if you are buying 100 shares for a $10,000 account then the maximum priced stock you should buy is 200/(0.07 x 100) minus commission and slippage or about $28.

A round lot is considered to be multiples of 100. Therefore, buying 100 shares is easy, but buying 50 shares is a bit harder although these days it is relatively easy. It will either cost you a bit more to buy or sell if you place a market order or will take you slightly longer to buy or sell if you place a limit order.

You can increase the price of the stock you buy in three ways:

- Increase the amount of risk you are willing to take, this is a bad choice;

- Buy odd lots of 50 shares. Buying 50 shares may cost you a bit more in and out but potentially will give you higher quality stocks to choose from;

- Increase the amount of money in your trading account.

Another problem which occurs when your online stock trading account size is small is that if you have one unexpected large loss you are potentially in trouble.

For example, you pick up 200 shares of a $20 stock with a tight stop. Unfortunately, bad earnings are declared and the stock opens the next day down $7. You are now down (7 x 200) $1,400 or 14%. In order to make this up, you would be required to have the remaining $8,600 gain 16.28%. On a $100,000 account you would only have to make a return of 1.42% on the remaining $98,600.

This brings up another good point. Typically, you would not want more than 10% of your account in any one stock. This would initially limit you to $1,000 available for each stock transaction.

One way around this is to buy fractional shares which I have recently become aware of in 2024. Thus, instead of buy whole shares you can purchase 2.5 shares or 3.1 shares depending on the amount of money you want to spend. For instance consider a stock you are interested in buying which is expensive. As an example MasterCard (symbol MA) was trading at $520.28 on Dec 4, 2024. To buy $1,000 worth of MA you would receive 1.922 shares. When it comes time to sell you could then sell 0.422 shares leaving you with 1.5 shares.

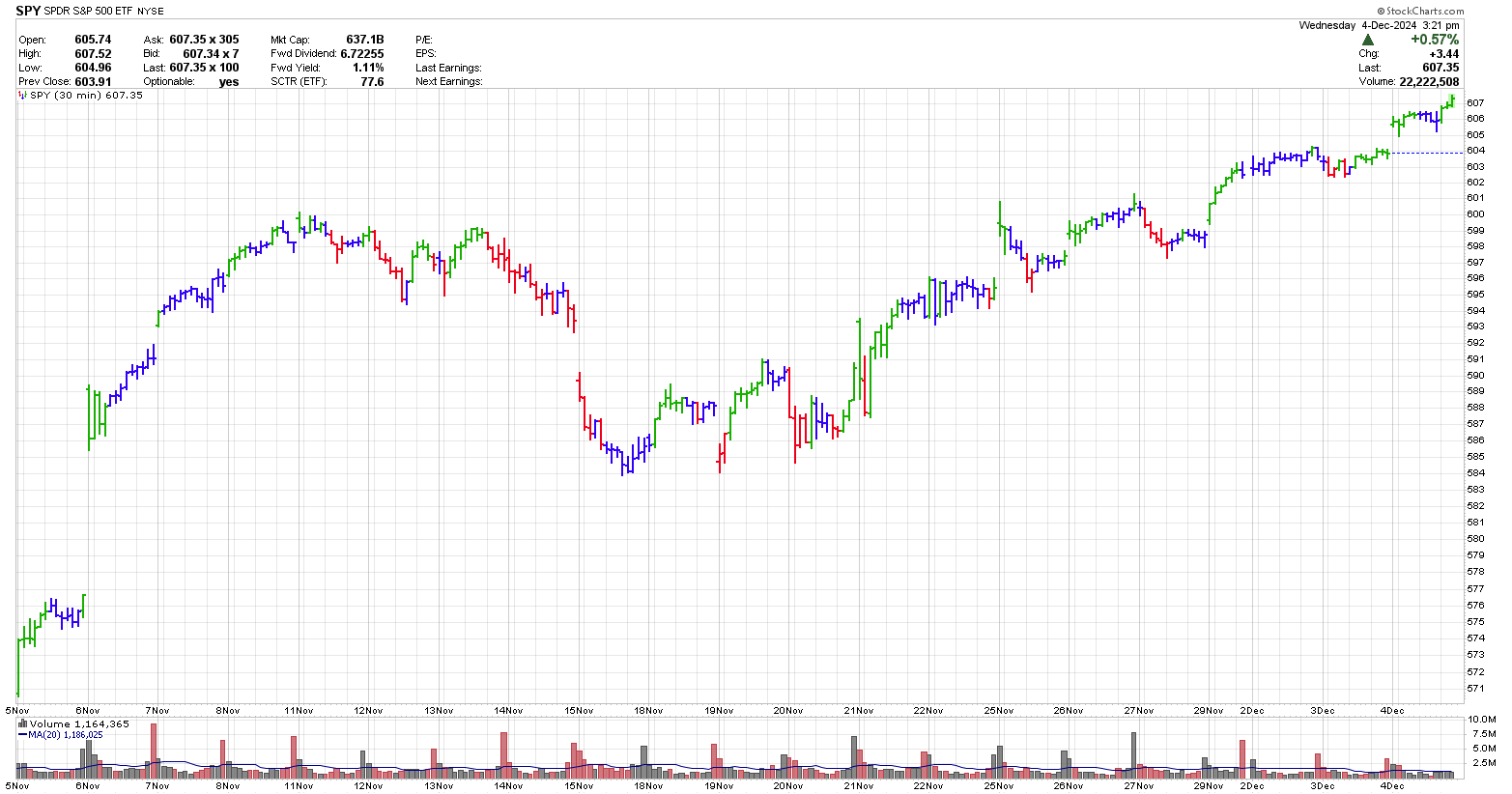

Another way, although this one may be a bit more risky is to trade options on higher priced stocks. This can be tricky as you will need to find an option that trades a reasonable volume. As an example, I have traded near the money options on SPY which are very easy to get in and out of as they trade a fairly large volume.

For instance, the chart below shows a 30-minute one month chart of the SPY. By dropping the timeline down you are able to reduce your risk. When you are patient and pick a higher probability trade with reasonable risk you will be able to increase your account size.

Alternately, instead of trading become an investor and choose high quality stocks as potentially identified by Investors Business Daily. Find high quality stocks and invest 10% of your account into 10 stocks. This will cut down on trading costs and as long a few of them do well your account will grow to the point that you will be able to start trading a portion of it.

For more information on account size you may want read our book reviews.

You can trade small accounts, just be aware that you need to be extra careful.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00