Commodity Charts of Precious Metals

Use these free commodity charts to help your

stock trading

When you think of precious metals you likely think of gold ingots. But this group also contains silver, platinum and palladium. When precious metals spot prices break to a new high or out of a channel this could be a good time to start looking at trading stocks in and related to mining.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

Mining stocks can be subdivided into three main groups: majors, juniors and explorers. The majors generally have multiple assets that are currently being mined. A few examples of major gold mining companies are: Barrick Gold, Newmont, Agnico Eagle and Wheaton Precious Metals. These companies have market capitalization of above around 30 billion dollars.

Junior minors typically have a deposit that is in the process of being turned into a mine.

Explorers are searching for gold and may have some indications that there is gold underneath but have yet to obtain information that would suggest that the mine could be built and be profitable.

During mining bull markets, you generally hear a lot of people talking about the junior resource stocks as they can typically be purchased cheaply and that is what many stock traders are looking for. For example, if a junior gold mining company reports on a discovery, their share price may, at least temporarily advance, resulting in a significant profit to the trader or investor.

Below is a table of the four main precious metals to give you an idea of the current price of each commodity.

The current,

unofficial, precious metals spot prices or quotes can be found

in the table below.

Common uses for gold include: jewellery, investment, bullion and coins. In many respects it has been used for financial purposes for 1,000s of year.

Silver has a lot more industrial uses than gold. Silver is used in photography, jewellery, solar cells, electronics, coins and has antibacterial properties.

Platinum is used in the electronics industry, as a catalyst and jewellery.

Similar to platinum, palladium finds its main usage in catalytic converters. It is also used in dentistry and electronics.

Obtaining trading information from commodity charts of precious metals is similar to understanding stock charts. Looking at these charts once in a while will give you an idea on what is happening to bullion as well as in the mining sectors.

Shown below are one year commodity charts of gold, silver, platinum and palladium. Most people would be familiar with buying silver or gold bullion but platinum and palladium can also be purchased.

Below is a 2-year chart of gold. You can get an idea about the strength or weakness in gold price by viewing the price chart. When gold is going higher in price a trade in a gold stock might be a good idea.

Below is a 2-year chart of silver. Silver and gold somewhat track each other. Silver is quite a bit less expensive than gold.

The 2-year chart of Platinum and Palladium are shown below. They differ quite a bit from each other and also from gold and silver as they are mainly used in catalytic converters and as such they have more industrial usage vs monetary usage.

Gold or Gold Miners

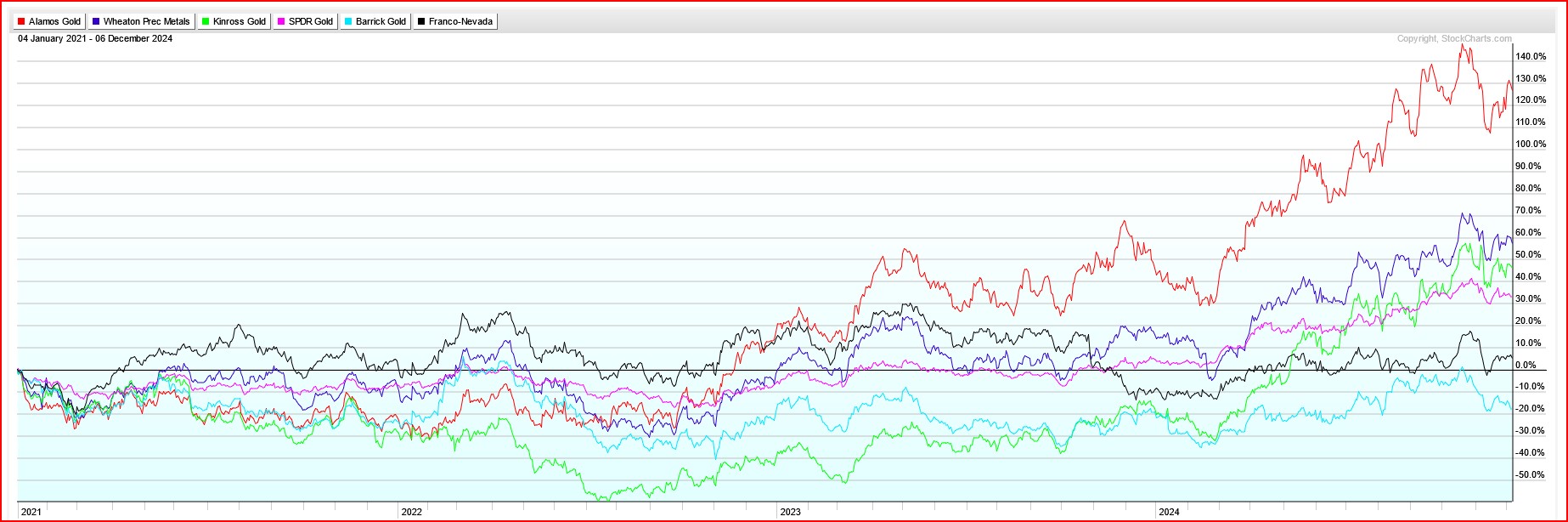

The above chart, courtesy of StockCharts.com shows the 4 year comparison of the price of gold (based on GDX) vs five different gold stocks. You can see that from these comparisons, Alamos Gold is outperforming the price of gold. Wheaton and Kinross are similar to the price of gold while Barrick and Franco-Nevada are under performing the price of gold.

Gold is a commodity while stocks are companies and have multiple inputs on their way to profits and as such their stock price may or may not follow the price of gold.

Gold companies need to be concerned with electricity costs, labour cost and availabity, training, insurance, weather, accounting, legal, transportation, repair and government concerns. All of these cost money and vary year by year. As such, depending on the year while the price of gold is a key component to profits the cost to mine the gold could be the difference between profits and a loss.

Companies Leveraged to the Price of Gold

As stated above, the profits gold companies produce is the difference between what it costs to product the gold vs what they get for the gold. After all of the expenses have been paid for everything else is profit. As such consider a company where the break even cost is $1,500 per ounce. Then anything over that is profit. When they produce 400,000 oz in a quarter and the price is $1,500 they have no profits, they just broke even. However, when the price of gold averages $1,600 they will make $40,000,000 in profits. So the extra $100 per ounce in the price of gold provides them with a large profit vs a break even situation.

The better gold miners have a lower all-in sustaining cost for the gold they produce.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00