A Bracket Order - Make the Market Work for You

A bracket order is an order which allows a trader to place a buy order which when filled will instantly put both a limit order and a stop loss order into the market. This gives you an advantage when you cannot be looking at the market all day long as you know you have a stop and target order in place as soon as you purchase a stock. Consider that there have been times that I have placed a bracket order the night before and before I turn on my screen in the morning, I have purchased and sold a portion of my position. In some cases, after the first sell the stock will reverse and I end up selling the rest of my position at break even or a slight loss. Without the original gain, this trade would have ended up being a losing trade.

For traders which just enter their orders one at a time they will either have their limit order in or their stop order in the market. This works well for those that only exit with a stop but can be frustrating for those that like to scale out.

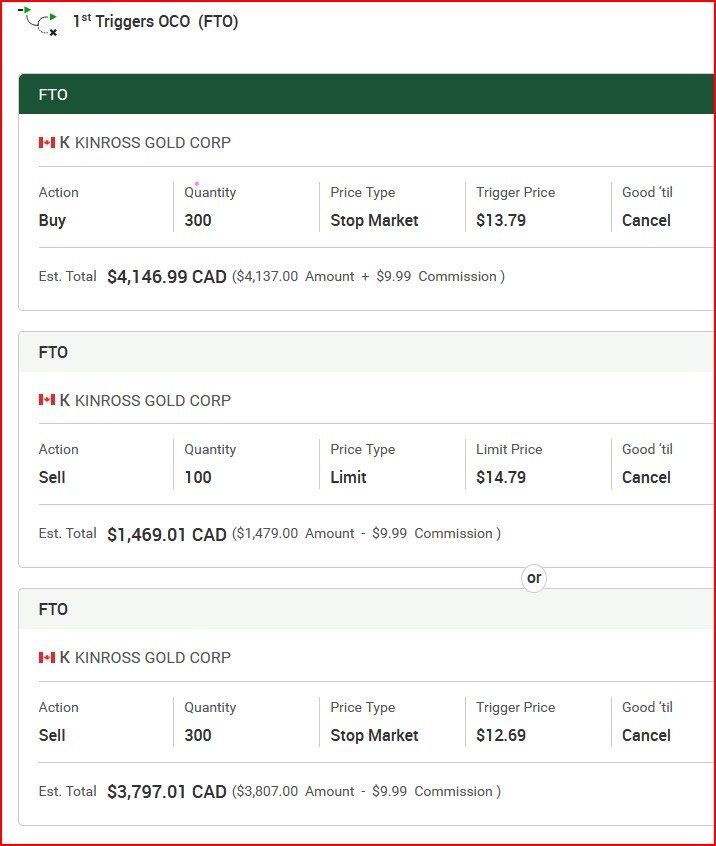

Bracket Order Example

Below, I have shown what a bracket order looks like when you are constructing it. On the first line, I am buying 300 shares using a stop market order at $13.79. When that gets filled, the broker will automatically put two orders into the market for me. They will put in a limit order to sell 100 shares at $14.79 and a stop market order to exit the postion at $12.69

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

What if you could do both?

Years ago, I asked one of my brokers this question and they told me this was impossible. Their system simply could not handle this. I questioned more and said how can a stock trade at say 11 and 10 within microseconds? They were not sure but knew their system did not do this.

Well, my other broker (Interactive Brokers) does. So when I am trading with them, I generally set up a bracket order to enter the trade. In fact, I place most of my trades after hours using buy stops or limit orders and attach a bracket order to the order. As soon as the order gets hit, I have a limit order and a stop loss order placed.

This has a large advantage for me as I know if I am in the stock I have both a stop loss protecting me against a major drop in the stock but I also have a profit target already working for me.

Now your trading plan needs to clearly define where to put both your limit and stop orders. These should be pre-calculated based on your trading plan.

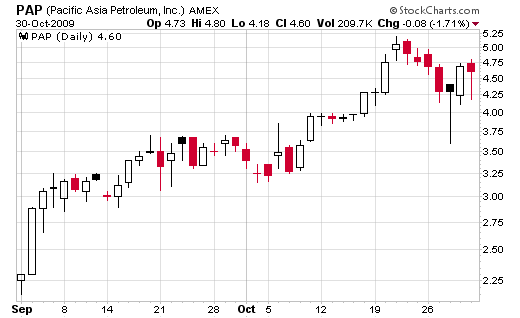

As an example of how this might work let's look at the chart below. In this case I placed a buy on stop at around 4.06 just above the consolidation which occurred between October 12 and October 15, 2009. I bought the stock when it made the break on October 16. As soon as the stock was purchased, two orders were entered into the market: a profit target of 4.99 and a stop loss was entered with a price of 3.89.

Stock chart provided courtesy of StochCharts.com

With a risk of 0.17 (4.06 - 3.89) on the trade I decided to set my limit order at 4.99 which shows a reward to risk ratio of around 5:1. Three days later my limit order got hit and I was out of the stock. In this case, the bracket order worked extremely well. Not all trades work as well as this one.

When you predetermine your exit, as I did in this case, you can, at times, sell way before a run is completed. For instance, if this stock had run to say 7.43 I would be out at 4.99 leaving a lot of profit on the table. One needs to check in with their goals and trading plan to determine if they want to go for the occasional home run or consistent small gains.

As discussed earlier, bracket orders are not offered by every brokerage company. Interactive Brokers is one broker that I know which offers bracket orders. TDWaterhouse also now offers this option.

So how do bracket orders turn a losing trade into a winner? Well look at this situation. You buy a stock and it is going nowhere. Sometimes you are up a bit sometimes down. You want to keep your stop loss in to protect yourself but do not have access to the market during the day. You wait. If you added a bracket to the trade you could potentially get out at a small profit while maintaining your protective stop. This can turn a potential losing trade into a small win.

If you think this type of trading strategy could be useful to you and want to give use it, you can pretend to set a bracket type order on your next couple of trades or look at your past trades and see if this type of order would help or hinder you.

I should mention that you can also place a stop limit order as your stop instead of just a stop loss. It really depends on how you trade.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Short Course

Introduction on How to Trade Stocks for Beginning Traders

New to trading, not sure where to start. I have put together a short course consisting of 18 lessons. Each lesson should take less than 5 minutes to review. Each lesson provides you with alternate resources to continue learning about that particular topic.

To learn more about this course and sign up please visit the course webpage by clicking the link below.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00