Finding a Stockbroker

Here are some questions you can ask to help you find the best online stockbroker

There are numerous stockbrokers to choose from these days. While the main focus is on what is it going to cost you to complete a trade there are also a number of other questions you should be asking before you decide which firm to work with.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

Questions you need to ask yourself

Before you begin, you should identify what type of trader you are. For example, some of the questions you should ask yourself before you start looking for a broker are:

- How many trades per month do I expect to place?

- Am I more likely to buy penny stocks or blue chip stocks?

- How will I be buying my shares: market, limit or on stop?

- Will I need to enter good to closed orders?

- Do I want the option of phoning an order in?

- What type of accounts (registered, margin) will I be opening?

- Will I be buying over the counter stocks?

- How much money will I be depositing in this account?

- Am I looking for a discount or full service broker?

- Will I be using bracket orders?

Some stock brokers may not be able to deal with registered plans, like RRSP's in Canada and 401K in the US which is a consideration for those who like to trade from their retirement plans.

From the above 10 considerations, rate which ones are your highest priority and then review the various online stockbrokers and see which one matches your main requirements.

Questions you need to ask a stockbroker

Things to watch out for when choosing a brokerage firm are:

- Is there a surcharges for buying large quantities of shares?

- Do I have to pay an extra charge for phone in orders?

- Do you care about my household income?

- What is the minimum account balance you require to waive fees?

- What are your trading fees?

- How do your trading fees vary with the number of shares I buy?

- Does the price of the stock change the fee charged?

- Is the platform easy to navigate?

- Is their access to free analysts research?

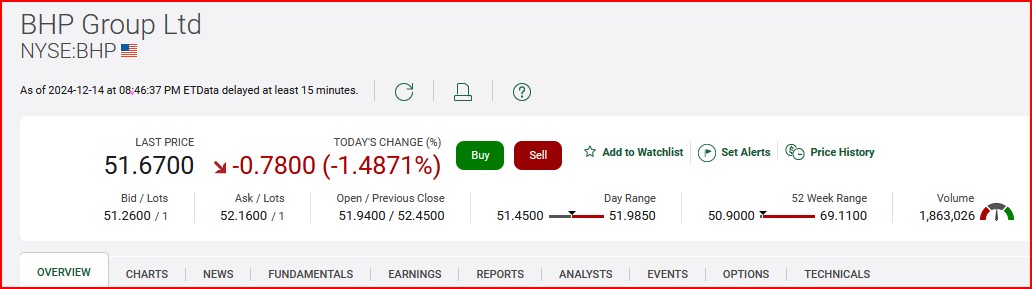

As an example of the type of research that TD Waterhouse provides their clients, consider the screen shot below which details the research that client can look up on just about any stock that trades in North America.

Recently, free trading or no commission trading has appeared. This somewhat concerns me as stockbrokers need to make their money somehow and when there is no commission one has to question how they are making it. Stockbrokers are businesses and as such need to make a profit.

One way they may make money is by having just slightly slower order execution resulting in your fill price just being slightly higher when you buy and slightly lower when you sell vs another firm. This may or may not occur however when you are considering a no commission stockbroker you should definitely ask them how their no commission platform works and how they are making their money.

Now that you have a rough idea of what you are looking for, you may want to look at a number of articles which compare the various online brokers. A good summary on US based brokers is published yearly by the American Association of Independent Investors.

Some of the more popular online trading firms in the US are: Fidelity, Schwab, Interactive Brokers, Vanguard, JP Morgan and Barclays.

In Canada some of the better online stockbrokers are: Questrade, TD Waterhouse, Interactive Brokers , Qtrade Direct Investing and BMO InvestorLine. Fees range anywhere from zero to $1.00 per 100 shares up to approximately $ 10.00 per trade. This range in stockbroker fees can have a major impact on your trading results.

Once you know what you want in a stockbroker and know what the brokerage firm offers, you should be able to choose the firm that will match your trading style, commission approach, account fees, platform and research .

You Can be a Successful Trader

When you are interested in improving your trading results, take the first step and start to get educated now. Open a trading account and start to learn the basics of trading and money management. Trade small and learn as you go. You can improve your trading skills. Think of all of the benefits which will occur if you can improve your trading results.

David Graeme-Smith offers a very simple approach to trading in his book Short Swing Trading. I purchased this program (now available on Kindle) many years ago and it has since been updated. There was one really interesting comment regarding the look of a chart which made the book very worth while, which I still use when I trade.

Described is a trading strategy which gets you into and out of the market generally within two weeks. David provided a complete set of trading rules which should progress your trading more than the current buy and hope strategy used by so many traders and investors today. Just by understanding the rules of his simple trading plan you should begin to see an improvement in your trading results.

If you want to look at more ways you can improve your trading trading skills visit our other product offerings.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00