Gambling versus a Calculated Financial Risk

Is Stock Trading Gambling?

There is a fine line between trading and gambling. Do you know the difference?

When you are trading in the stock market you are taking a financial risk. You weigh the odds of losing a predetermined amount of cash versus the odds of winning. When the odds are in your favour then you trade the stock. Once entered, you should know your exit point and provided there is not an unexpected gap in the price, this should be approximately where you exit the position.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

When you bet, generally you either win or lose. If you place a wager of $1,000 at the table in Las Vegas or on a horse and you lose, you lose $1,000. Consider a slot machine. When you play a $10 slot machine

which require 5 stars to win

and you get 4 stars you lose the $10. It is either a win or a loss, there is no between

When trading properly, prior to placing a trade, you should have identified your exit strategy. This will be a price at which you will exit the trade when it goes against you. This can be done by either making a mental note of the price you will get out at or by entering a stop loss order. A stop loss order is a price where the stockbroker will automatically sell your stock if the price is reached.

When you buy 100 shares of a $10 stock, it will cost you a $1,000. When you set a stop loss order at $9.49 and the stock price goes against you, your stop is hit, you will have $949 (provided there is no slippage) minus commission or around $945 left. In this case you lost but still have 94.5% of your capital versus 0% when you bet.

Since all traders are betting that the stock they buy is going to go in their favor, one could generalize and say all traders are gamblers.

There is nothing the average trader can do to influence the direction of a stock. If you cannot influence the direction the stock takes, then you are betting on the direction.

Use proper money management techniques and turn your wager into a trade.

If you think you are gambling on too many of your trades you may want to read some of the books summarized in our self-help section which may help you with this challenge.

Stock Trading vs Gambling

Many ask, is stock trading gambling? I think the short answer is yes.

Let's delve into the differences between stock trading vs gambling. From my point of view when you are gambling you either win or you lose your whole position. Consider the Roulette wheel. You place a bet on red and it comes up black. You lost what ever you bet.

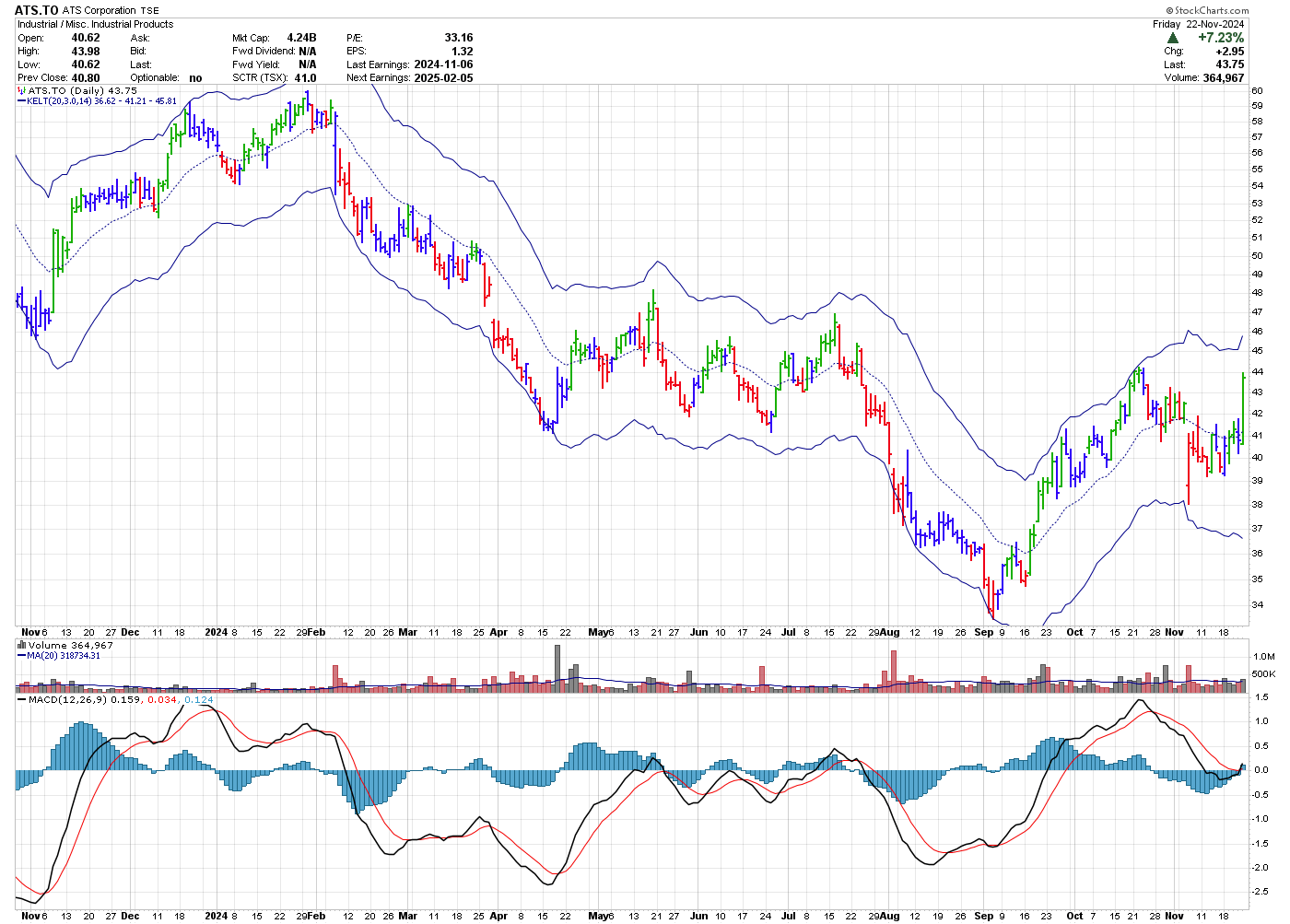

Trading is a bit different. Consider the divergence trade in ATS.TO shown below. In early September 2024 you note that there is a divergence between price and both the MACD histogram and MACD line. To see this compare the price and MACD on September 5 with the price and MACD on April 17, 2024.

On September 17 you place a Buy on Stop (BoS) at $36.51 just above the high on September 12. You decide to place your stop one ATR(14) below the low on September 5 at $32.47. Thus, the risk on the trade is $4.04 per share (36.51 - 32.47). When buying 200 shares, your risk will be $808.

From the above, when you put $808 on a Roulette game you either win or lose what you bet, there is no in between. Losing the gamble would be simmilar to the ATS trade and having it be a losing trade. However, to enter the ATS trade will require $7,302 plus commision.

Once into the trade, you can scale out and get to break even as the trade goes in your favour.

Depending on how you scale out you would either still be in the trade with a small position or completely out of it due to the drop in early November.

In a losing situation, the end result of the gamble and trade are the same, a loss of $808. However, while you have no influence on either outcome, you can obtain information of a trade which could, over a number of trades, give you a higher probability of a win vs a 50/50 chance.

In the ATS.TO example, consider that there is a divergence between both the MACD line and MACD histogram. The price has also reached the Keltner channel lower band which does not happen that often and finally, you are buying on a higher high with a stop loss point below the last low. The buy point is also a green bar within the Elder Impulse system. All of these clues point to a positive outcome vs a negative outcome.

So, is stock trading gambling? I still think yes but the trader has the ability to only take higher probability trades vs the gambler. Although, I have met some professional gamblers who make a living out of gambling. So there appears that for some gamblers, they have mastered their trade.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00