Developing Trading Systems

Turn your ideas into trading systems

To develop trading systems first you need a trading concept. There are hundreds, if not thousands, of trading ideas. While you may think this is a key part of your system, based on the book by Van K Tharp "Trade you Way to Financial Freedom" it only accounts for about 10% of your success.

A trading system is more than just an entry technique. Most beginner traders believe that the entry system is the system. However, the main parts of a full trading system also include where to get out, how many shares you should purchase, what you will trade, the type of charts you will use and how much of your account to trade.

Bulls and bears are used to describe the up and down of the market. A bull tends to use its horns to lift oncoming threats out of

the way and raises them into the air which is the direction of a bull market. Bears

tend to come down on you from above hence they represent a bearish market or

one that is falling.

The above desk figurines depict the back and forth of the market as it unpredictably tends to move in a preferred direction. They make good gifts for traders, stock brokers or financial advisors.

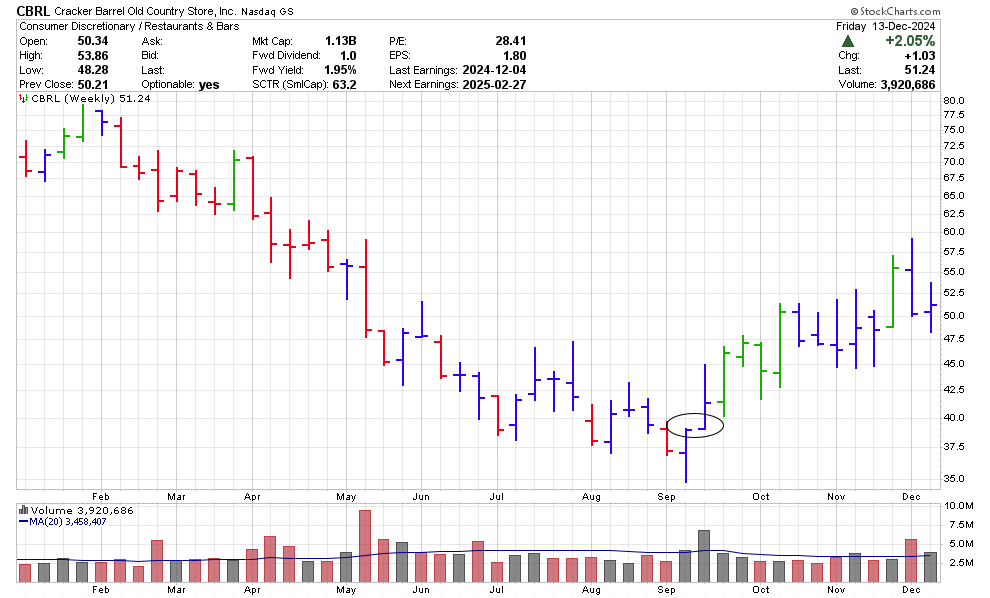

The weekly stock of Cracker Barrel Old Coutry Store (CBRL) is shown below illustrates the system that I will be using as an example. This is only an idea. You need to determine if it is worth trading.

Idea: When a stock makes a new weekly low, closes above last week's close, closes above the open and closes in the top 75% of its weekly trading range is this a buy signal? The weekly volume is set to greater than 1,000,000 and the minimum price for the scan is $1.

Let's think about the idea. The stock hit a new low during the week of September 13, 2024. This is a bearish signal. However, also in that same week the stock closed higher. This is a bullish sign. If it was so weak, why did it close higher? Is it under valued? Is there a fundamental change going on? Our initial trading systems will be based on this idea.

While the scan did not look for a weekly divergence in the MACD historgram that could have been added. In this case, there was no weekly MACD histogram divergence however, there was a very clear one on the daily.

On Friday September 13, 2024, 22 stocks were found. In the case of CBRL, this was a pretty good trade. The high of that bar was $39.08 and the trader decides to place a buy on stop at $39.11 Monday morning. With a Stop loss at $34.64, just below the low of $34.70 the risk on the trade is $4.47 or 11.4%.

Selling 1/3 of the position at $48.05 (2x the risk) would have resulted in a sale on October 17. the trader would now have a stop in the market perhaps around $44.49 waiting for the next up move.

Chart courtesy of StockCharts.com

For the above trade, the trader needs to identify how many shares of CBRL they are going to buy? As the risk on the trade is $4.47 the trader needs to examine their account size. Let's assume the trader has a $50,000 trading account and is willing to risk 2% of that account or $1,000. Therefore, the trader can purchase 1,000/4.47 or 223 shares of stock.To keep things simple let's buy 210 shares so 70 shares (1/3) can be sold at the first exit.

After the first sale, the trader is up $625 minus commissions. With a stop in at $44.49, another $5.39 x 140 or $753 minus commissions is "guaranteed" as long as there isn't a gap on the day the stock gets sold.

Note that 2% of your account is pretty much the maximum you would want to risk. Better is likely to start out with 0.5 to 1.0% risk. That is to say only risk $250 to $500.

Before you get too excited, during the same week, looking at the other 21 potential trades, 5 were wins, 2 likely broke even, 10 were losses and 4 others were losses. However those final 4 would not have been entered when a buy on stop above the weekly high was used as those four stocks would not have been purchases. This is why money management skills are so important. Based on this relatively basic examination, this entry system does not look like a great trading entry.

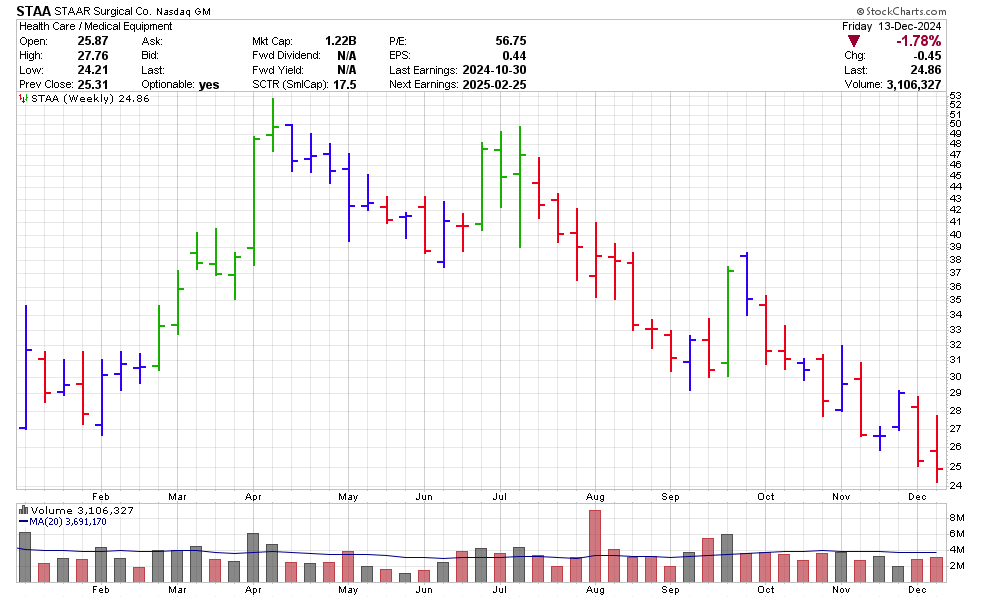

When a daily divergence is added, the number of potential stocks drops to 8 however, only 2 are winners, 5 are losers and 1 was not entered due to the next weeks high not triggering the trade. So overall this entry system does not seem that great. An example of one of the losses is STAA which looked pretty good initially and then dropped. When the first 1/3 of the position was sold at 1x risk, this could have been a wining trade.

Chart courtesy of StockCharts.com

Perhaps the initial exit needs to be 1x risk. When the initial profit target is reduced to 1x the risk then 5 trades would have been winners with 2 losses with 1 no entry.

In the case of the first profit target being 1x risk, STAA had 3 winning trades. Can you find them?

Our stop loss and profit targets would have made a difference between the number of winners vs the number of losses the trader had.

This is why when you trade you need to know your exit strategies.

In summary, building trading systems is relatively easy if you can identify an idea that has the potential to offer you a profitable trade. Trade management is much harder.

In order to come up with trading ideas to build trading systems you may want to keep up with the market news by reading magazines which discuss the stock market.

Gifts for Stock Traders - Stock traders are a different breed. For the stock trader in your life or as a present to yourself consider getting a trading mug. This can be used throughout the day to sip on your favourite beverage and remind you that you are a trader.

Monte Carlo Simulator

for Traders

Having troubles sticking with your trading system?

Having troubles sticking with your trading system?

Do you move from system to system looking for the one system that will bring you riches?

Perhaps you already have it and tossed it aside when it went into a down period.

Using this Excel based program will show you what you can expect out of your trading system once you know the % wins and profit factor.

Stop wasting your time searching for the perfect system (which does not exist) and start trading.

$20.00